Understanding the Differences Between Actual Cash Value and Replacement Cost Coverage

When purchasing homeowners or renters insurance, one of the key decisions you’ll need to make is choosing between Actual Cash Value (ACV) and Replacement Cost Coverage. Understanding these two types…

How to Assess the Value of Your Personal Property for Insurance Purposes

Accurately assessing the value of your personal property is essential for securing appropriate insurance coverage. Whether you’re purchasing a new policy or updating an existing one, knowing the true value…

The Benefits of Bundling Your Auto and Home Insurance Policies

Bundling your auto and home insurance policies can be a strategic move that offers numerous benefits. By consolidating your coverage with a single insurance provider, you can streamline your insurance…

Common Homeowners Insurance Exclusions and How to Address Them

Homeowners insurance provides essential protection for your home and belongings, but it’s crucial to understand that not all risks are covered. Policies often come with exclusions—specific scenarios or types of…

How to Evaluate and Choose a Reliable Property and Casualty Insurance Provider

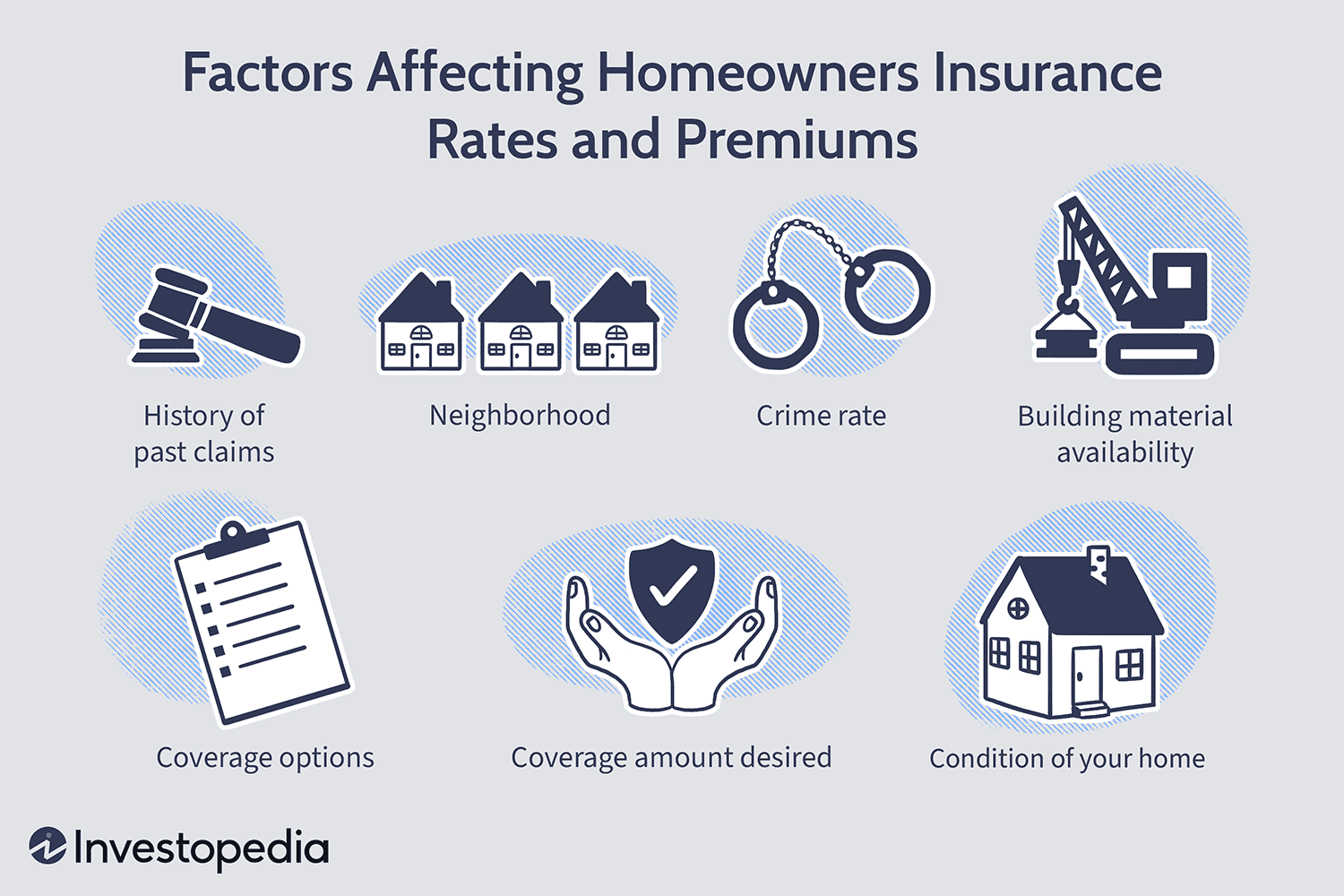

Choosing a reliable property and casualty insurance provider is crucial for ensuring you have the right coverage for your home, vehicle, and other valuable assets. With numerous options available, finding…

The Impact of Home Renovations on Your Property Insurance

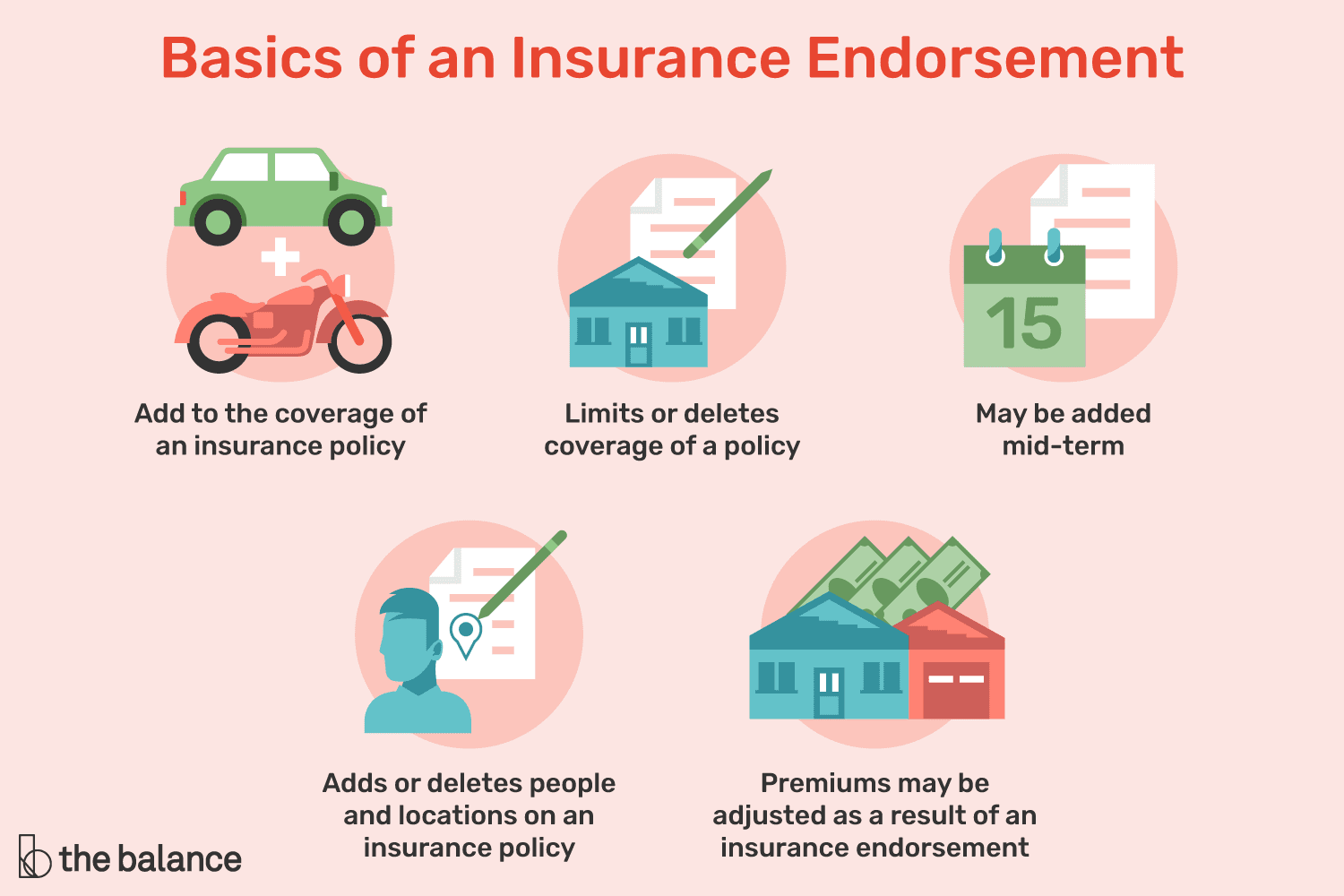

Home renovations can significantly enhance the value and functionality of your property. However, they can also impact your property insurance in various ways. Understanding how renovations affect your coverage is…

How Property Insurance Covers Natural Disasters: What You Need to Know

Natural disasters can be devastating, causing significant damage to homes and property. Understanding how property insurance covers these events is crucial for ensuring you have the protection you need. Here’s…

The Importance of Umbrella Insurance for Extra Liability Protection

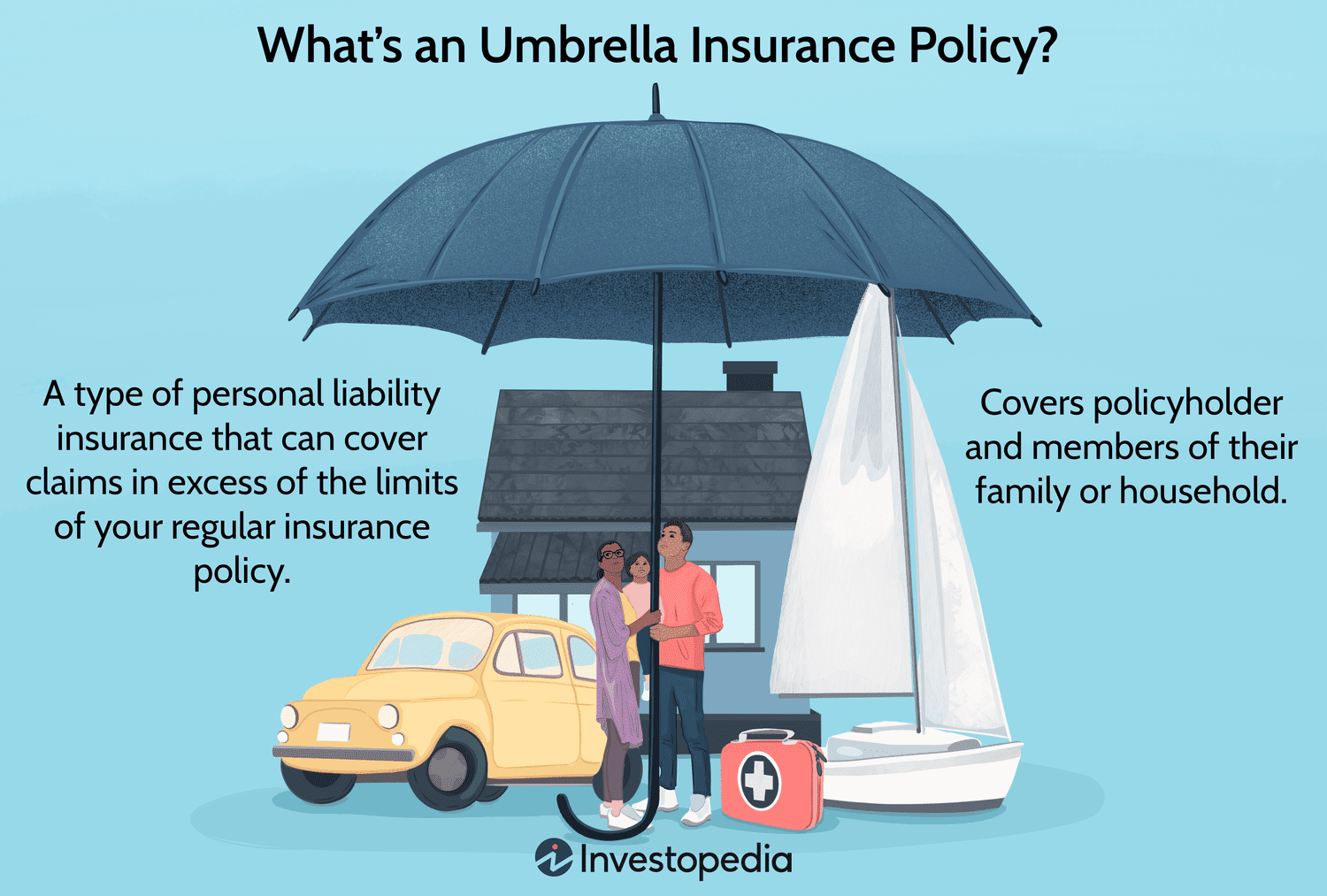

Umbrella insurance is a vital yet often overlooked component of comprehensive risk management. It provides an additional layer of liability coverage beyond the limits of your standard auto, homeowners, or…

How to Lower Your Auto Insurance Premiums Without Compromising Coverage

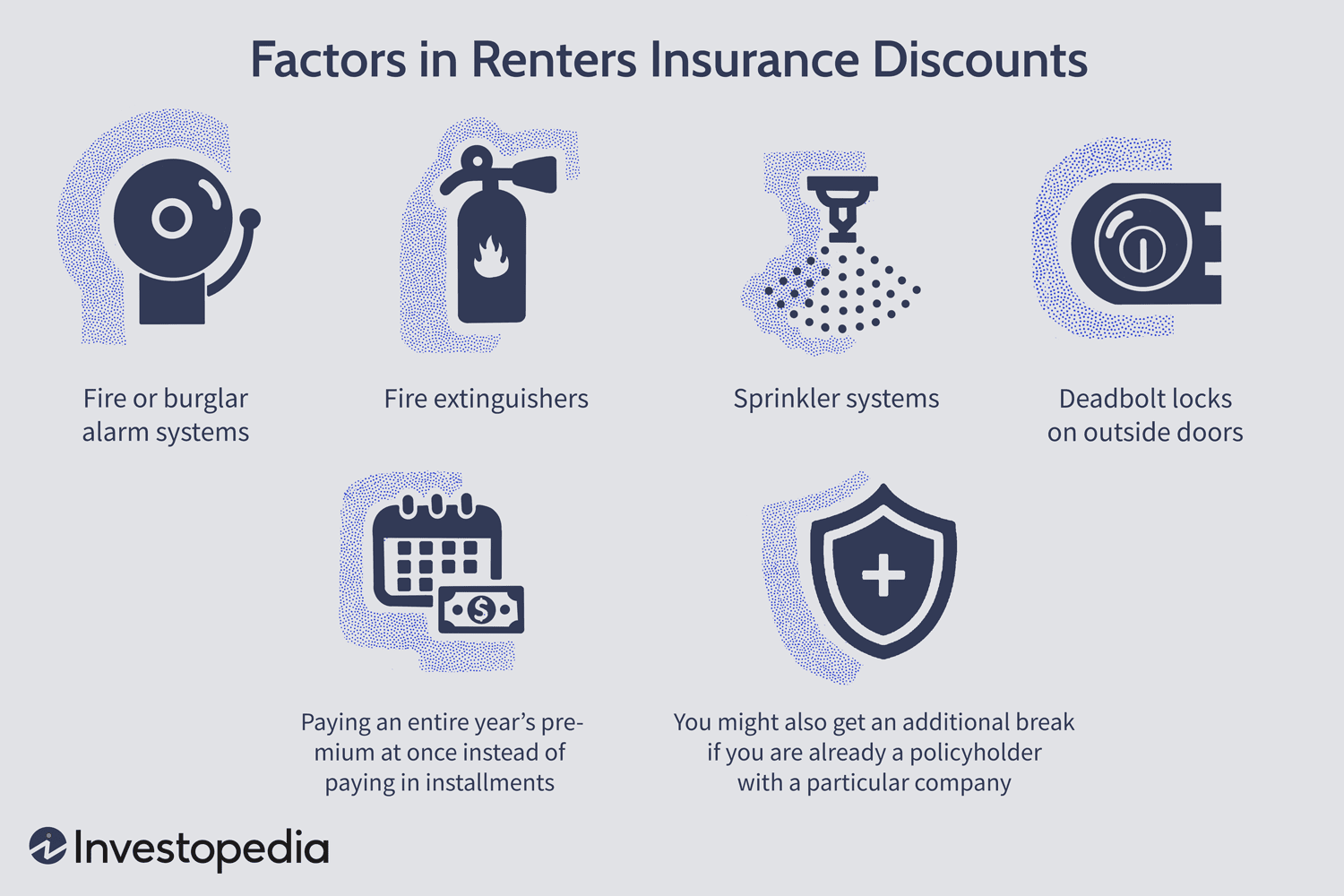

Auto insurance is a crucial expense for vehicle owners, but finding ways to reduce premiums without sacrificing coverage can be a significant financial benefit. Here are effective strategies to lower…

Understanding Liability Coverage in Auto Insurance

Liability coverage is a fundamental component of auto insurance that protects you financially if you’re responsible for causing an accident. It covers the costs associated with injuries and property damage…

Understanding the Differences Between Actual Cash Value and Replacement Cost Coverage

Understanding the Differences Between Actual Cash Value and Replacement Cost Coverage How to Assess the Value of Your Personal Property for Insurance Purposes

How to Assess the Value of Your Personal Property for Insurance Purposes The Benefits of Bundling Your Auto and Home Insurance Policies

The Benefits of Bundling Your Auto and Home Insurance Policies Common Homeowners Insurance Exclusions and How to Address Them

Common Homeowners Insurance Exclusions and How to Address Them How to Evaluate and Choose a Reliable Property and Casualty Insurance Provider

How to Evaluate and Choose a Reliable Property and Casualty Insurance Provider The Impact of Home Renovations on Your Property Insurance

The Impact of Home Renovations on Your Property Insurance How Property Insurance Covers Natural Disasters: What You Need to Know

How Property Insurance Covers Natural Disasters: What You Need to Know The Importance of Umbrella Insurance for Extra Liability Protection

The Importance of Umbrella Insurance for Extra Liability Protection How to Lower Your Auto Insurance Premiums Without Compromising Coverage

How to Lower Your Auto Insurance Premiums Without Compromising Coverage Understanding Liability Coverage in Auto Insurance

Understanding Liability Coverage in Auto Insurance