The Benefits of Life Insurance for Business Owners

Life insurance is a vital tool not just for personal financial planning but also for business owners. Integrating life insurance into your business strategy can offer numerous benefits, from ensuring…

How Life Insurance Can Be Used for Estate Planning

Life insurance is not just a tool for providing financial protection for your loved ones in the event of your death—it also plays a vital role in estate planning. Integrating…

Comparing Life Insurance Providers: What to Look For

Choosing the right life insurance provider is a critical decision that can impact your financial security and peace of mind. With numerous insurance companies offering various policies, it’s essential to…

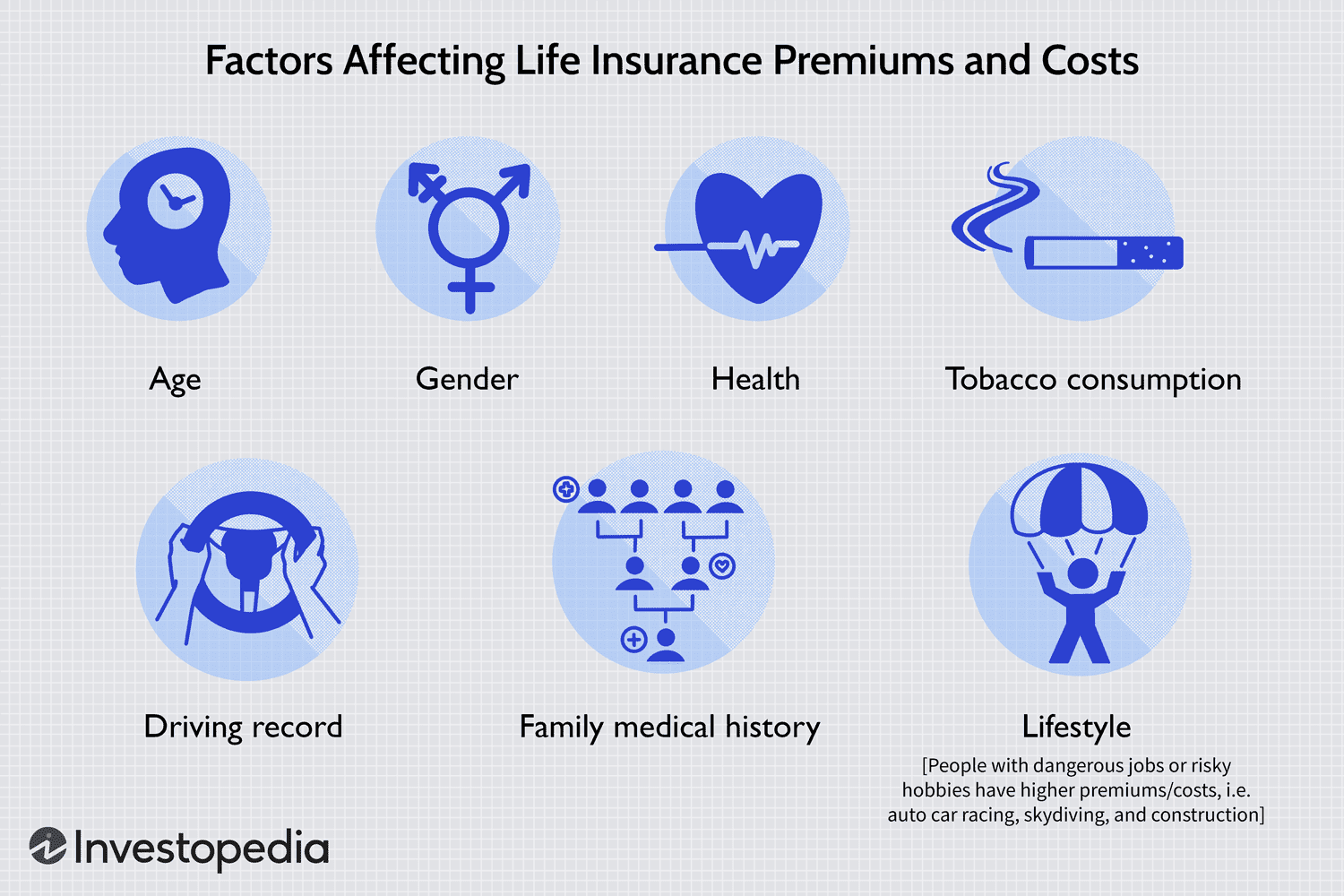

The Impact of Health and Lifestyle on Life Insurance Premiums

When applying for life insurance, your premiums are significantly influenced by your health and lifestyle. Insurers use these factors to assess the level of risk you pose, which in turn…

How to Calculate the Right Amount of Life Insurance Coverage

Determining the right amount of life insurance coverage is a crucial step in ensuring that your loved ones are financially protected in the event of your untimely death. The right…

The Importance of Life Insurance for Young Families

Life insurance is often considered a crucial aspect of financial planning, but its significance is particularly profound for young families. As life unfolds with new responsibilities and goals, ensuring that…

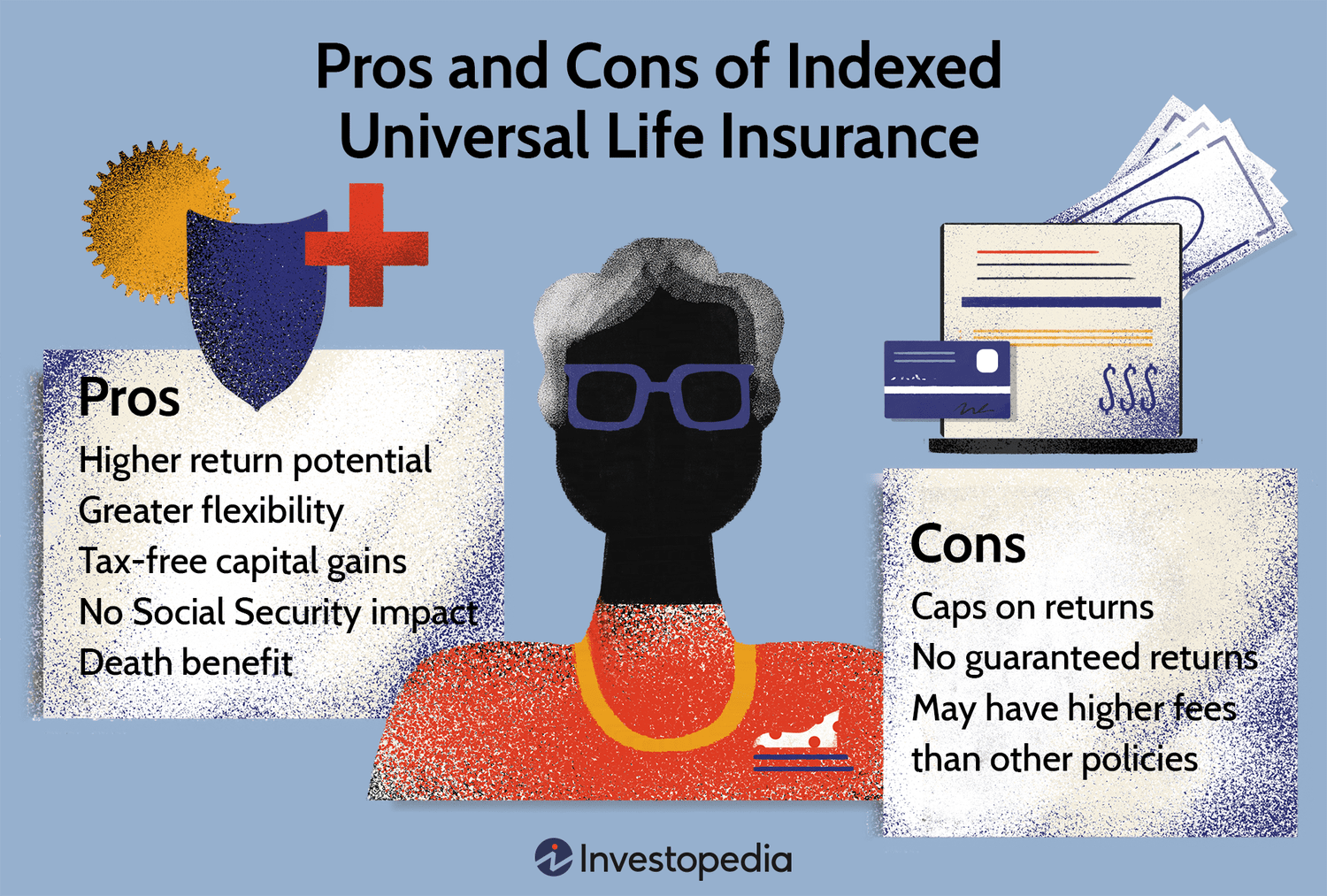

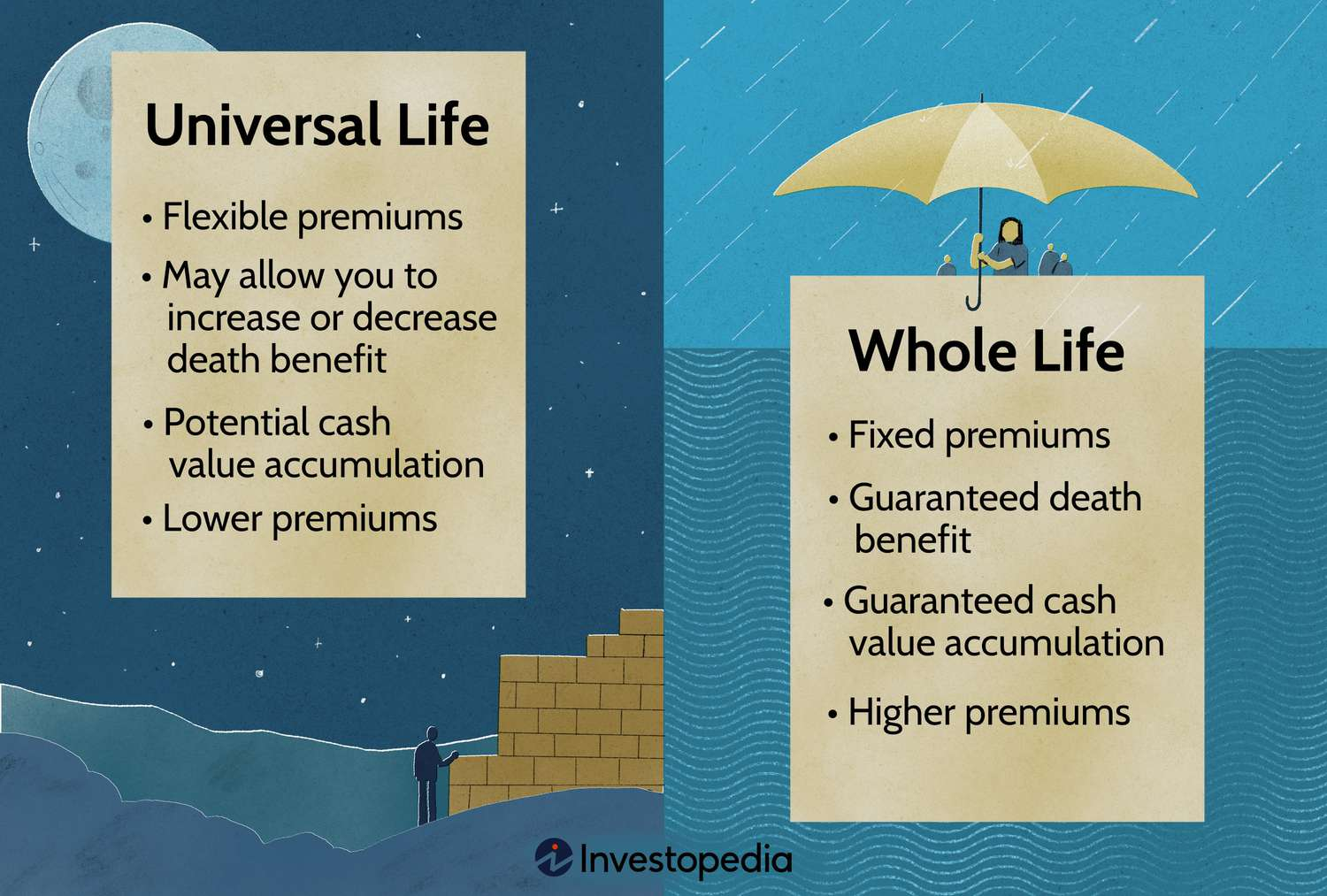

Universal Life Insurance: Flexibility and Financial Planning

Universal life insurance is a versatile form of permanent life insurance that combines a death benefit with a flexible savings component. Unlike traditional whole life insurance, which offers fixed premiums…

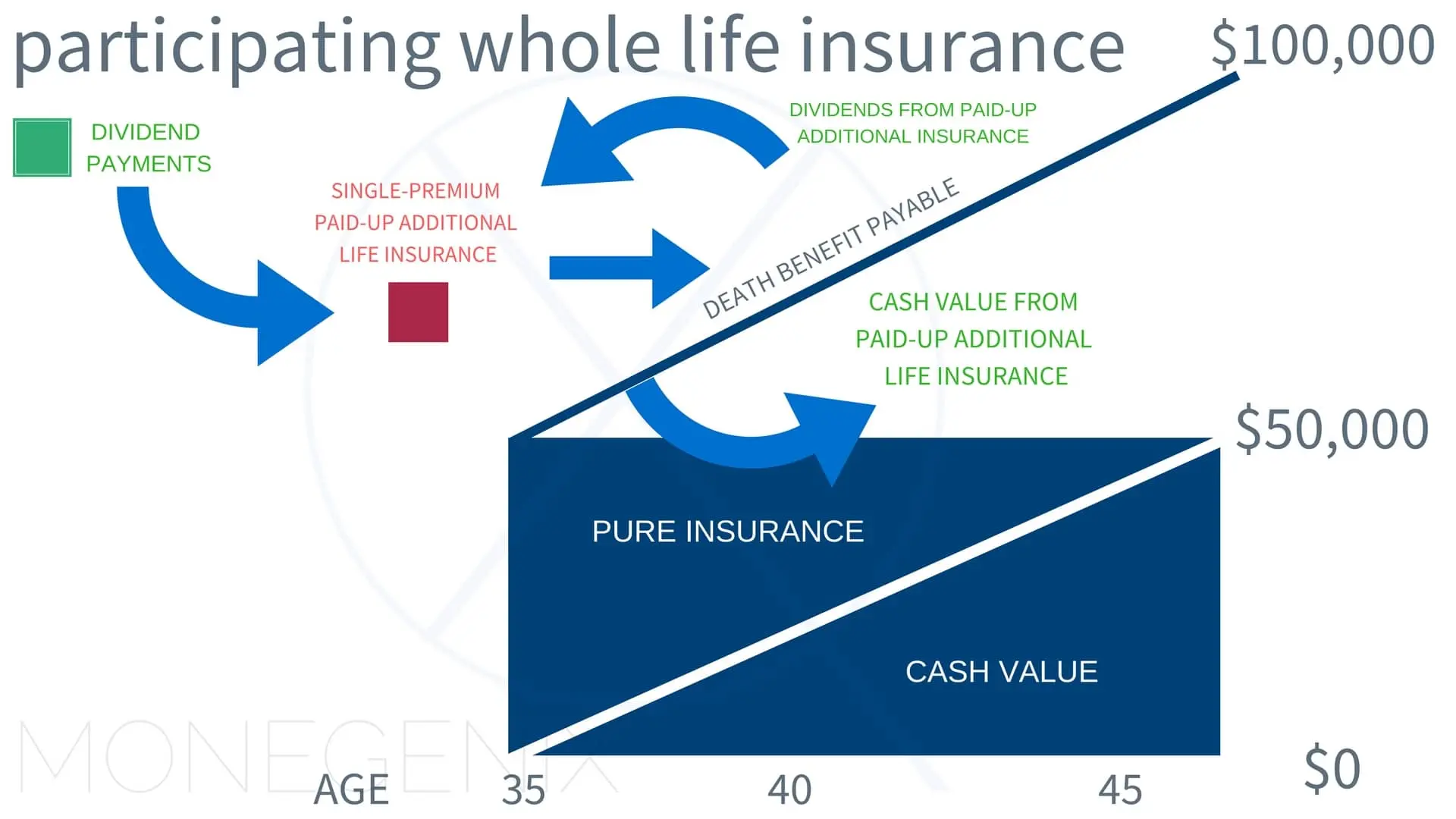

The Role of Cash Value in Whole Life Insurance

Whole life insurance is a popular type of permanent life insurance that offers lifelong coverage and includes a unique feature known as cash value. Understanding the role of cash value…

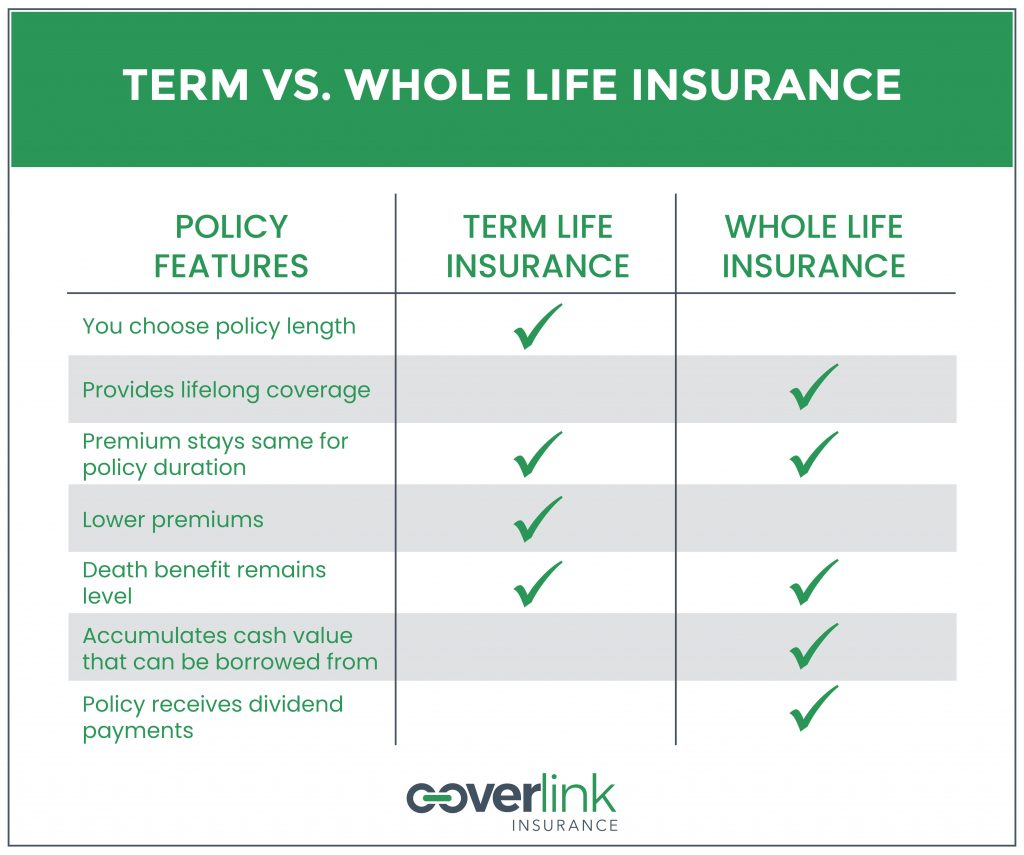

How to Choose Between Term and Whole Life Insurance

When considering life insurance, one of the fundamental decisions you’ll face is choosing between term life insurance and whole life insurance. Both types of policies offer unique benefits and are…

Whole Life Insurance Explained: Benefits and Drawbacks

Whole life insurance is one of the most traditional forms of permanent life insurance, offering lifelong coverage and a range of benefits. Understanding how it works, along with its advantages…