How to Use Telemedicine Services Through Your Health Insurance

Telemedicine has revolutionized healthcare by providing convenient access to medical services without the need for in-person visits. This remote healthcare option is especially valuable for managing routine health concerns, seeking…

Medicare vs. Medicaid: Which Program is Right for You?

Choosing between Medicare and Medicaid can be a pivotal decision for individuals navigating their healthcare coverage options. Both programs provide essential health benefits, but they cater to different populations and…

The Importance of Network Coverage in Health Insurance Plans

When selecting a health insurance plan, one of the most critical factors to consider is network coverage. Network coverage refers to the list of healthcare providers, including doctors, hospitals, and…

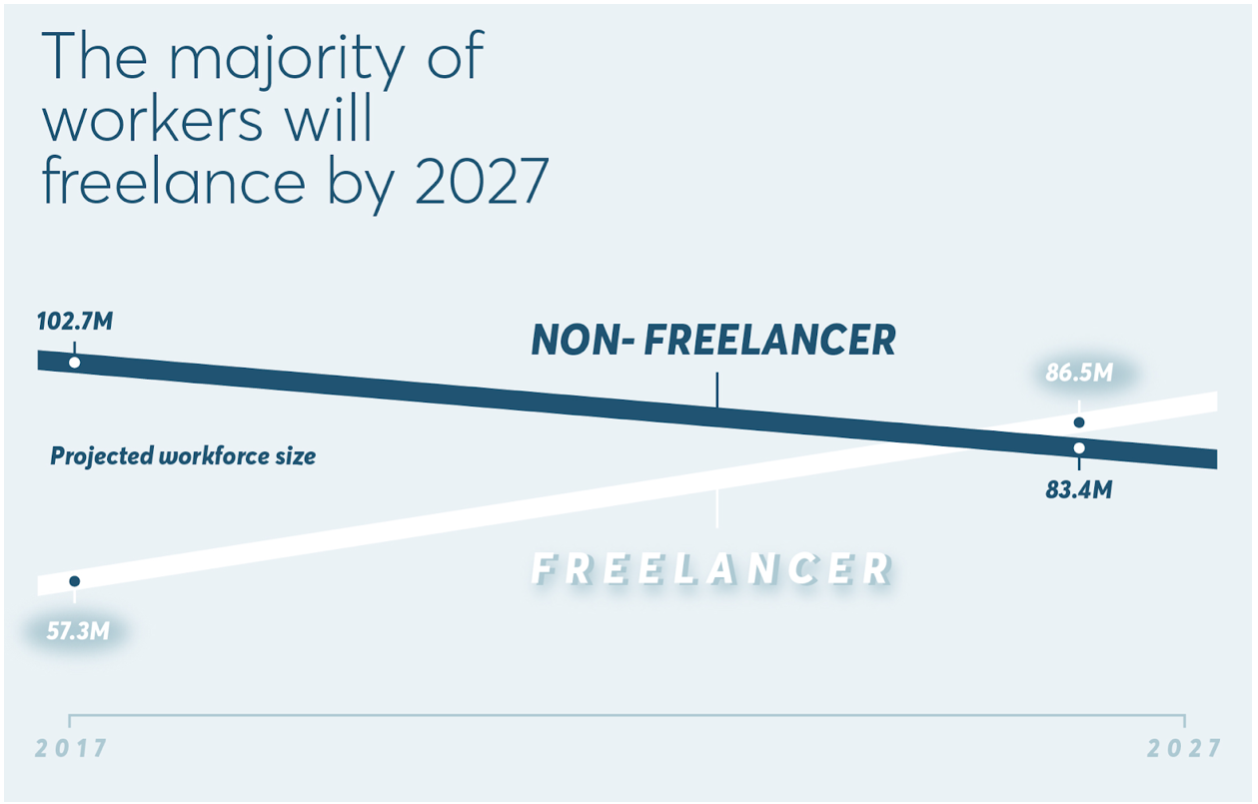

How to Find Affordable Health Insurance for Self-Employed Individuals

Finding affordable health insurance can be particularly challenging for self-employed individuals, as they lack the benefit of employer-sponsored coverage and often face higher premiums and out-of-pocket costs. However, with the…

The Pros and Cons of High-Deductible Health Insurance Plans

High-deductible health insurance plans (HDHPs) are gaining popularity due to their lower monthly premiums and the potential for tax advantages. However, they come with both benefits and drawbacks that can…

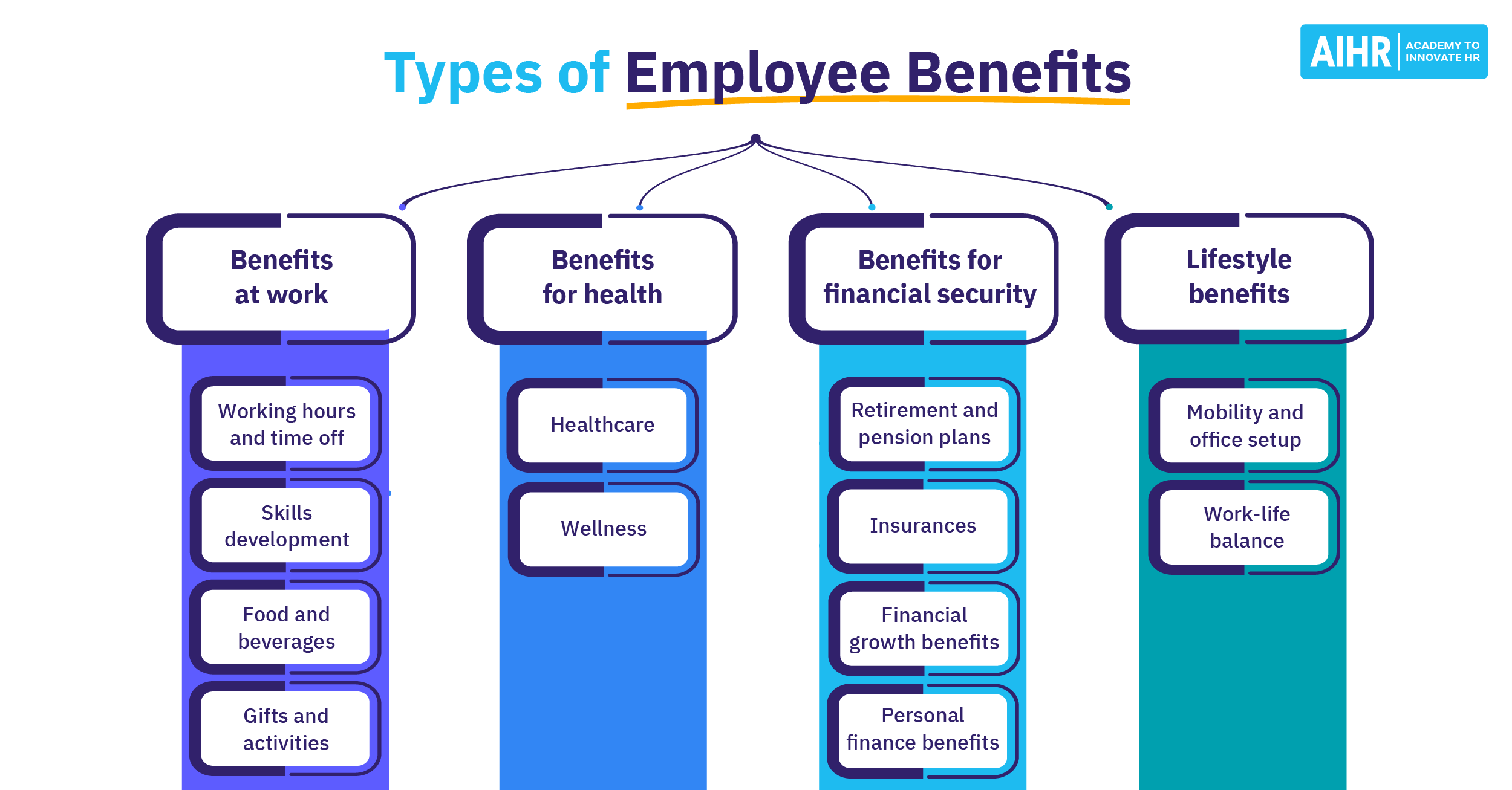

Exploring Group Health Insurance Options Through Employers

Group health insurance offered through employers is a popular and valuable option for many individuals seeking comprehensive and cost-effective healthcare coverage. Employer-sponsored plans provide a range of benefits that can…

The Impact of Pre-existing Conditions on Health Insurance

Pre-existing conditions have long been a significant factor in determining health insurance coverage and costs. Understanding how pre-existing conditions affect health insurance is crucial for making informed decisions about your…

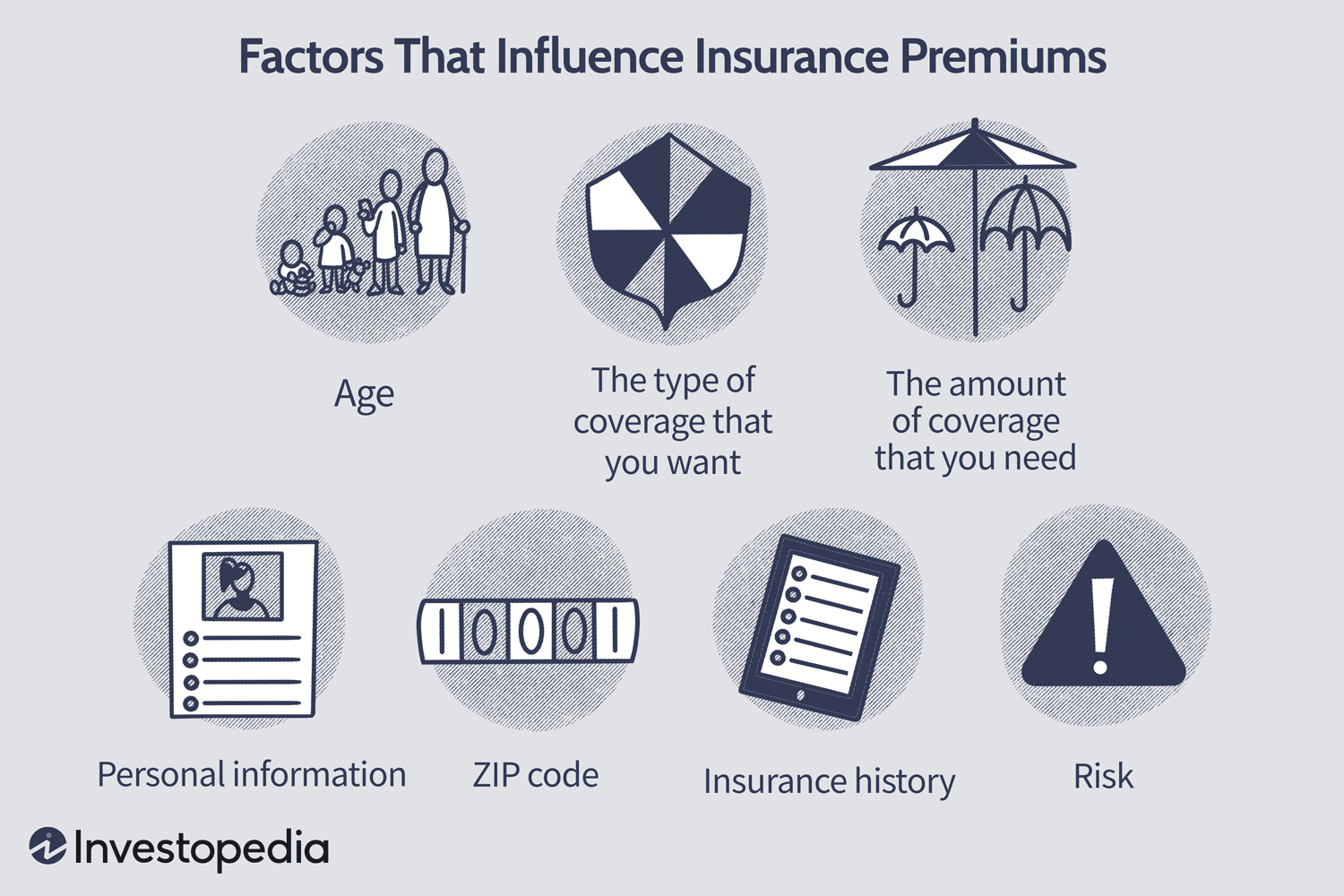

How to Estimate Your Annual Health Insurance Costs

Estimating your annual health insurance costs is crucial for effective financial planning and ensuring you can afford the coverage you need. Health insurance expenses can be complex, involving more than…

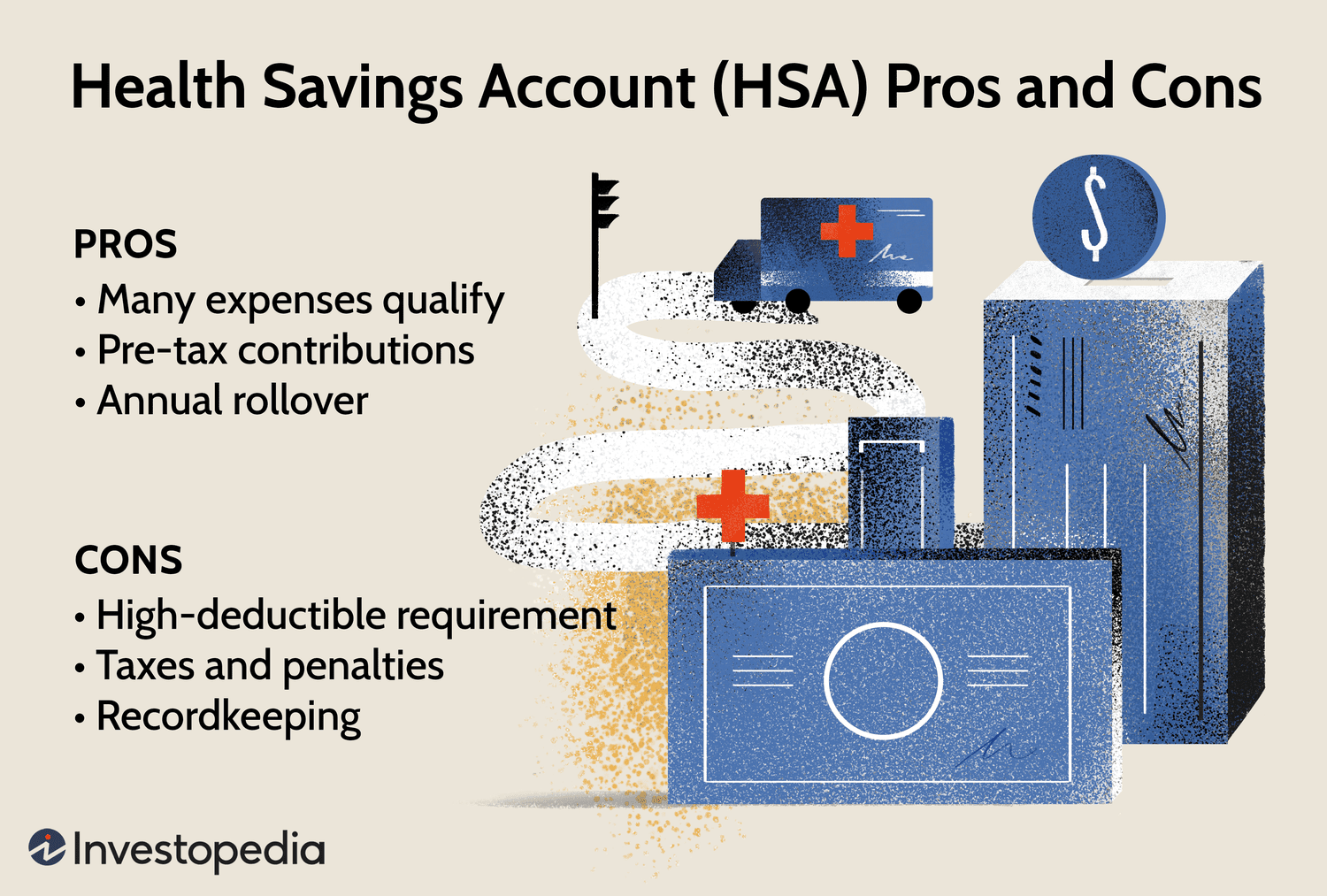

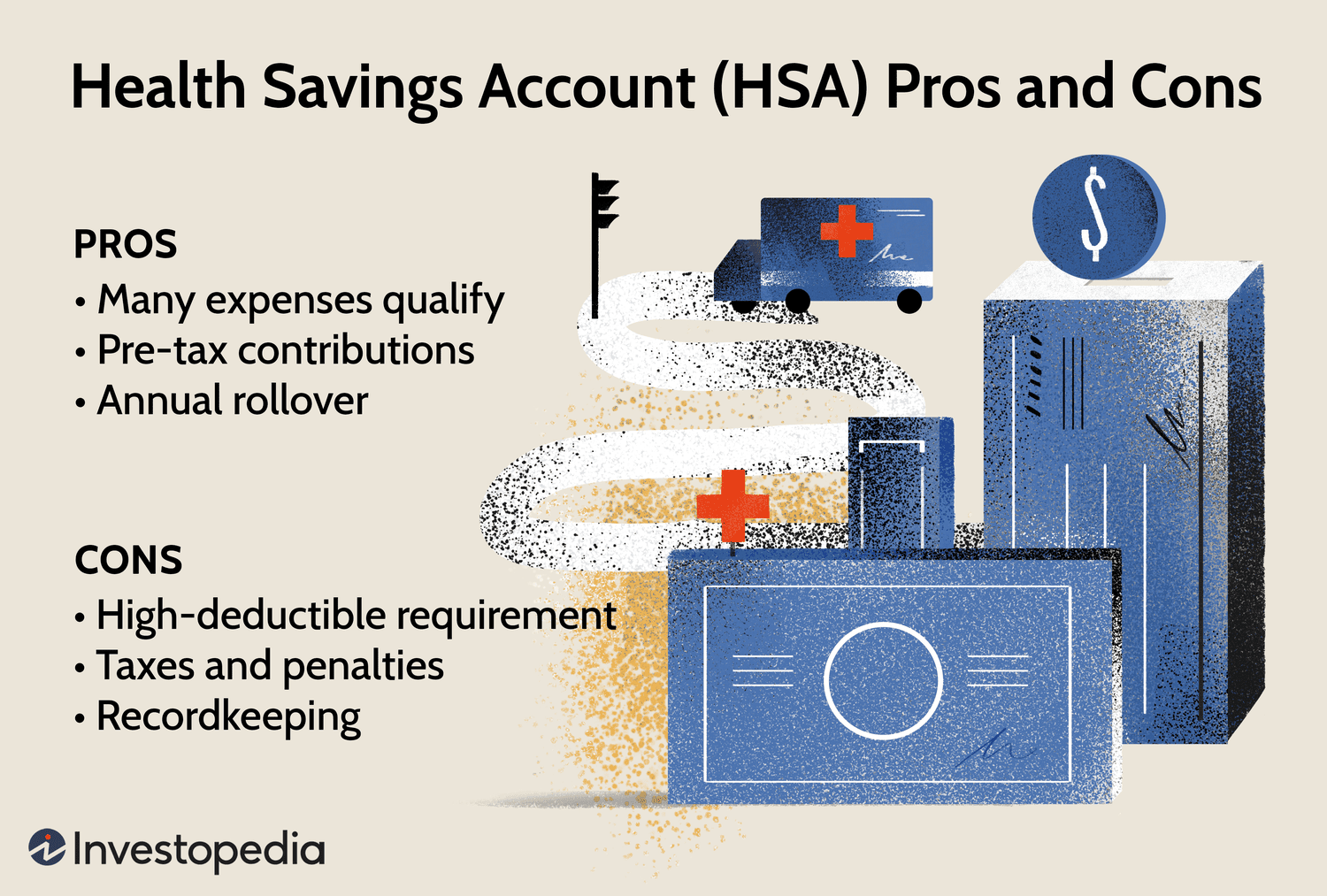

The Role of Health Savings Accounts (HSAs) in Health Insurance

Health Savings Accounts (HSAs) are a powerful tool that complements high-deductible health insurance plans by offering a tax-advantaged way to save for and manage healthcare expenses. Understanding how HSAs work…

Understanding Coverage for Prescription Drugs

Navigating prescription drug coverage can be a daunting task, given the complexity of health insurance plans and varying drug benefits. Understanding how prescription drug coverage works is crucial for managing…