When applying for life insurance, your premiums are significantly influenced by your health and lifestyle. Insurers use these factors to assess the level of risk you pose, which in turn affects how much you’ll pay for coverage. Understanding how health and lifestyle impact your life insurance premiums can help you make informed decisions and potentially lower your costs. This article explores the key factors related to health and lifestyle that affect life insurance premiums and offers tips on how to manage these factors.

1. Health Status and Medical History

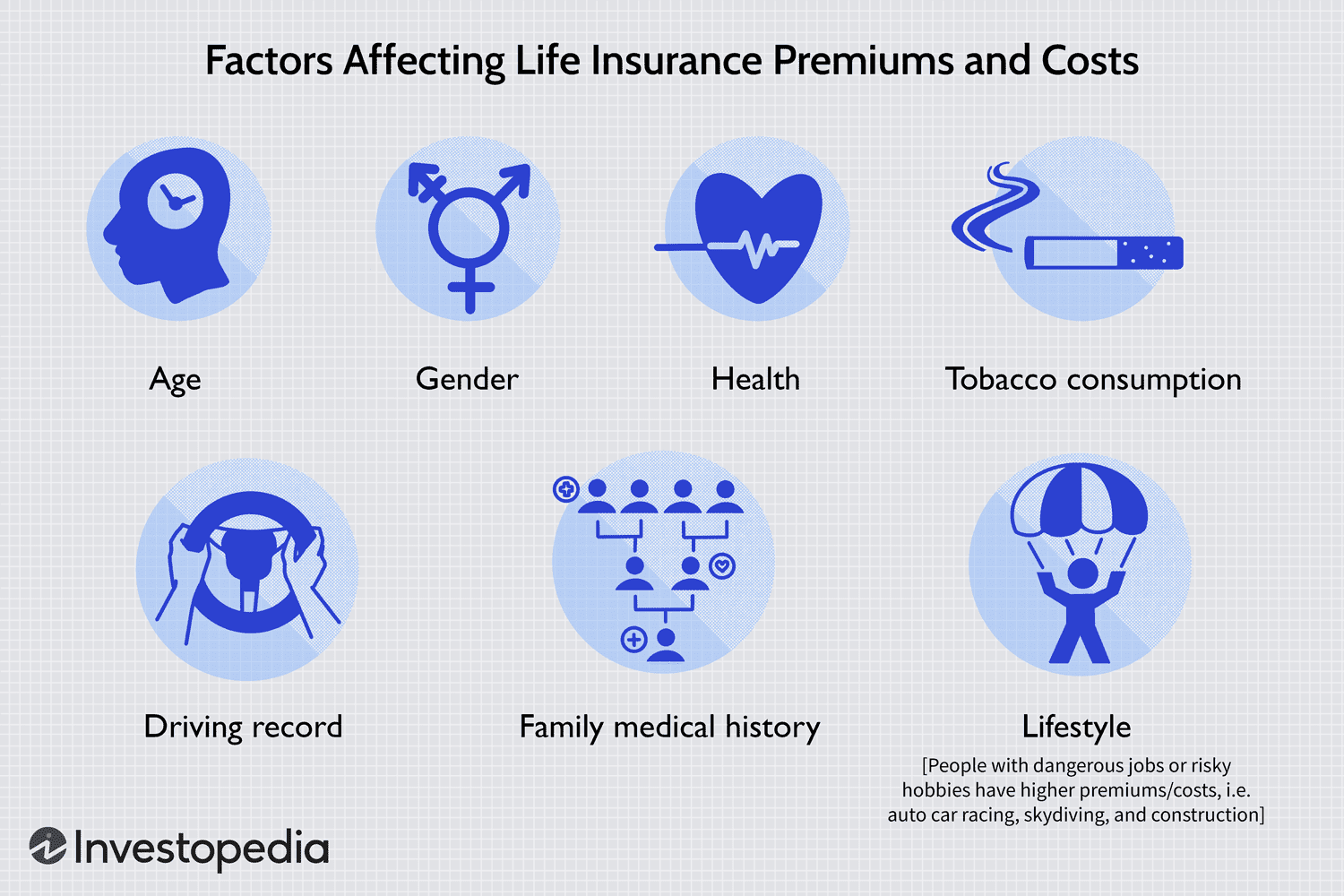

Your overall health and medical history are crucial elements in determining your life insurance premiums. Insurance companies assess your health risks by reviewing:

- Current Health Conditions: Chronic illnesses such as diabetes, heart disease, or hypertension can lead to higher premiums. Insurers evaluate the severity of your conditions and how well they are managed to gauge your risk level.

- Medical History: A history of serious health issues, even if they are under control, can impact your premiums. Conditions such as cancer or stroke may raise concerns about potential future health problems, leading to higher rates.

- Family Medical History: Insurers may consider your family’s medical history, including hereditary conditions, to assess your risk. A family history of major illnesses can suggest a higher likelihood of developing similar conditions.

2. Lifestyle Choices

Your lifestyle choices play a significant role in determining your life insurance premiums. Insurers evaluate various aspects of your lifestyle, including:

- Smoking and Tobacco Use: Smokers generally face significantly higher premiums compared to non-smokers. Tobacco use is linked to a higher risk of developing serious health conditions such as lung cancer, heart disease, and respiratory issues. Quitting smoking can lead to reduced premiums over time.

- Alcohol Consumption: Excessive alcohol consumption can increase health risks, leading to higher premiums. Insurers may inquire about your drinking habits and any related health issues. Moderation or abstinence can help in securing lower rates.

- Physical Activity: Regular exercise and an active lifestyle are viewed positively by insurers. Physical activity is associated with lower risks of various health issues, which can contribute to lower premiums. Maintaining a healthy weight through exercise and a balanced diet is beneficial.

- Diet and Nutrition: A healthy diet is another factor that insurers consider. Poor dietary habits, such as a high intake of processed foods and unhealthy fats, can be associated with higher health risks. A balanced diet can positively impact your insurance rates.

3. Occupation and Hobbies

Certain professions and hobbies can also affect your life insurance premiums. Insurers evaluate:

- Occupational Hazards: Jobs that involve high-risk activities, such as construction work or firefighting, can lead to higher premiums. These roles are associated with a greater risk of accidents or health issues.

- Hobbies: Engaging in high-risk hobbies, such as skydiving, rock climbing, or motorcycle riding, may increase your premiums. Insurers view these activities as contributing to a higher risk profile.

4. Managing Health and Lifestyle

To potentially lower your life insurance premiums, consider the following tips:

- Improve Your Health: Regular check-ups, a healthy diet, and regular exercise can enhance your overall health and potentially lead to better insurance rates.

- Quit Smoking: If you smoke, quitting can result in significant savings on your premiums. Many insurers offer reduced rates for non-smokers, and some may even adjust your premiums after a year of being smoke-free.

- Moderate Alcohol Consumption: Reducing or eliminating excessive alcohol intake can improve your health profile and potentially lower your premiums.

- Maintain a Healthy Weight: Achieving and maintaining a healthy weight through a balanced diet and regular exercise can positively impact your health status and insurance rates.

5. Seek Professional Advice

Consulting with a financial advisor or insurance agent can provide personalized guidance on managing your health and lifestyle to optimize your life insurance premiums. They can help you understand how specific factors affect your rates and suggest strategies for improving your risk profile.

Conclusion

Health and lifestyle choices play a pivotal role in determining life insurance premiums. By understanding how factors such as medical conditions, smoking, alcohol consumption, and lifestyle habits impact your rates, you can take proactive steps to manage your risk profile. Improving your health and making positive lifestyle changes can lead to more favorable insurance premiums, ultimately contributing to better financial security for you and your loved ones. Consulting with professionals can further assist in navigating the complexities of life insurance and achieving the best coverage at the most reasonable cost.