Whole life insurance is a popular type of permanent life insurance that offers lifelong coverage and includes a unique feature known as cash value. Understanding the role of cash value in whole life insurance is crucial for evaluating the benefits and limitations of this financial product. This article explores how cash value works, its benefits, and how it can be utilized in your financial planning.

What is Cash Value?

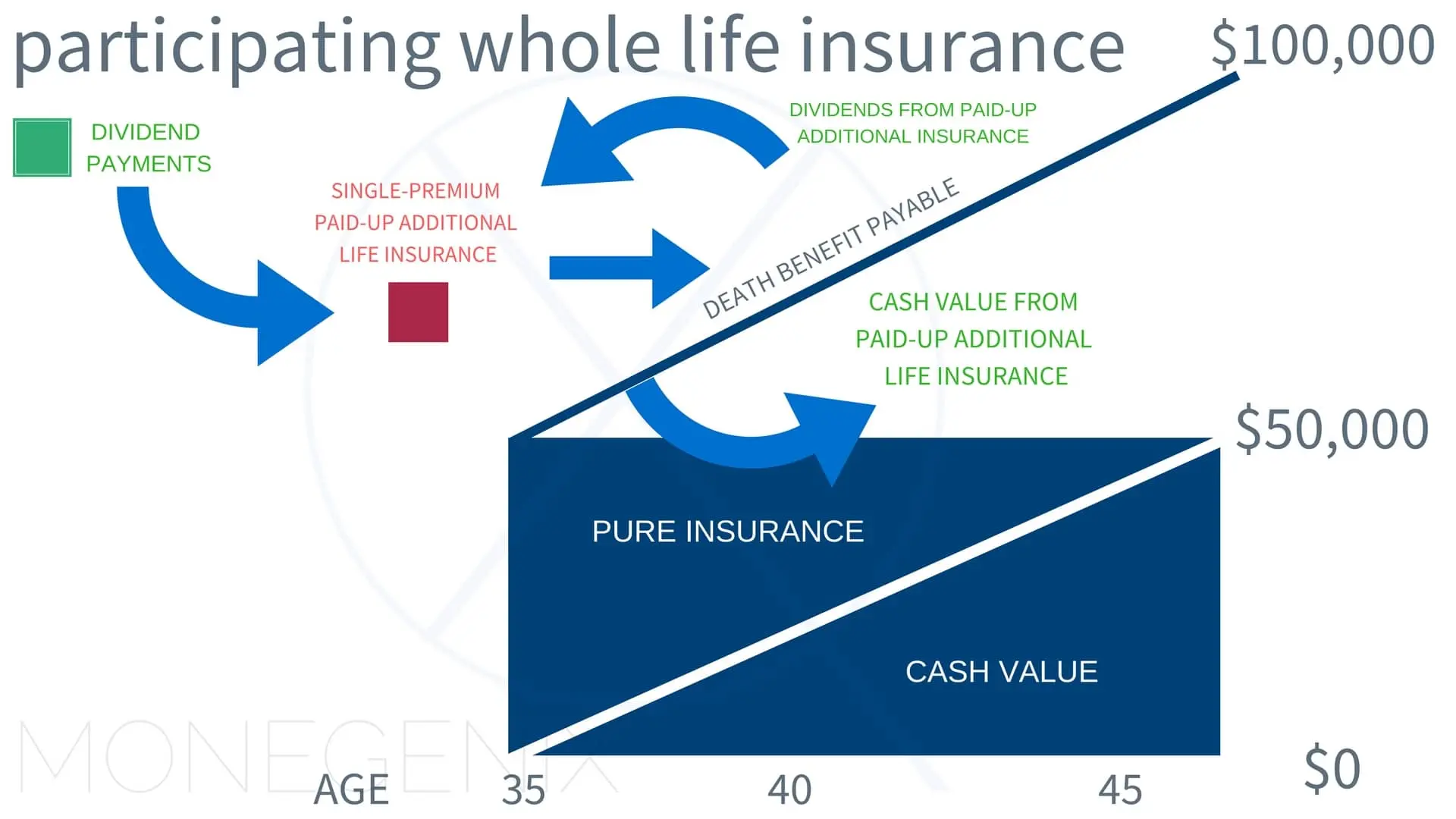

Cash value is a component of whole life insurance that accumulates over time as part of your policy. Each time you pay a premium, a portion of it goes toward building this cash value, which grows at a guaranteed rate set by the insurance company. Unlike term life insurance, which provides coverage for a specific period without any cash value, whole life insurance offers this added financial benefit.

How Cash Value Accumulates

The accumulation of cash value in a whole life insurance policy is relatively slow but steady. Premiums paid into the policy are divided into two parts: one part covers the cost of insurance and administrative fees, while the other part contributes to the cash value. The cash value grows over time based on a guaranteed interest rate and, in some policies, additional dividends paid by the insurer.

Benefits of Cash Value

- Savings Component: One of the primary advantages of cash value is that it acts as a savings component within your life insurance policy. Over time, the cash value grows and can be accessed through withdrawals or policy loans. This provides a potential source of emergency funds or can be used for other financial needs.

- Tax Advantages: The cash value in a whole life insurance policy grows on a tax-deferred basis, meaning you won’t owe taxes on the growth until you withdraw it. This can be beneficial for long-term financial planning, allowing your money to grow without immediate tax implications.

- Policy Loans: You can borrow against the cash value of your whole life insurance policy. These loans typically come with favorable terms and lower interest rates compared to other types of loans. Borrowed funds can be used for various purposes, such as paying for education, medical expenses, or investments. However, it’s important to repay these loans to avoid reducing the death benefit or accumulating interest.

- Flexible Premium Payments: Some whole life insurance policies allow you to use the accumulated cash value to pay premiums. This can provide flexibility in managing your policy’s costs, particularly if your financial situation changes.

- Estate Planning Tool: The cash value in whole life insurance can also play a role in estate planning. The death benefit, along with the cash value, can be used to cover estate taxes or provide financial support to heirs, helping to preserve your estate’s value.

Considerations and Limitations

- Growth Rate: While the cash value accumulates over time, it typically grows at a slower rate compared to other investment options. The guaranteed interest rate may not keep pace with inflation or offer the same growth potential as stocks or mutual funds.

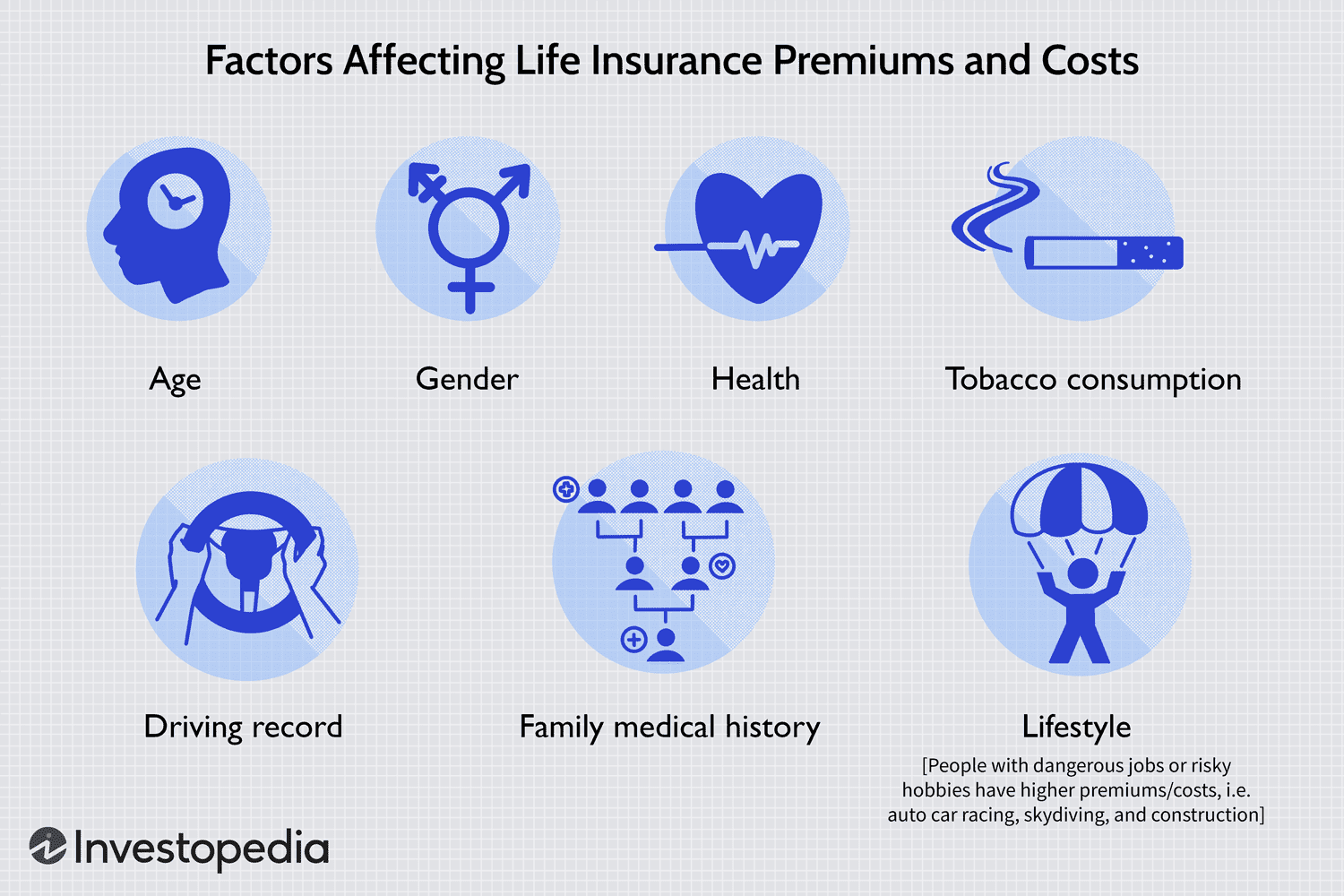

- Cost of Insurance: The cost of insurance within a whole life policy can be higher compared to term life insurance. These higher premiums are partly due to the cash value component and the lifelong coverage provided.

- Surrender Charges: If you decide to cancel your whole life insurance policy early, you may incur surrender charges that reduce the cash value you receive. These charges are generally higher in the early years of the policy.

- Complexity: Whole life insurance policies can be complex, with various features and terms related to cash value and dividends. Understanding these aspects may require careful review and guidance from a financial advisor.

Conclusion

The cash value component of whole life insurance offers a unique blend of savings and insurance protection. It provides a way to build financial value within your policy, with tax advantages, borrowing options, and potential flexibility in premium payments. However, it’s essential to weigh these benefits against the costs and complexities associated with whole life insurance.

Before committing to a whole life insurance policy, consider your financial goals, needs, and the role that cash value can play in your overall financial strategy. Consulting with a financial advisor can help you navigate the details and determine if whole life insurance with its cash value component is the right choice for your long-term financial planning.