Universal life insurance is a versatile form of permanent life insurance that combines a death benefit with a flexible savings component. Unlike traditional whole life insurance, which offers fixed premiums and benefits, universal life insurance provides a range of options that can be tailored to fit your financial needs and goals. In this article, we’ll explore the flexibility of universal life insurance and how it can be a valuable tool for financial planning.

What is Universal Life Insurance?

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. The cash value grows based on a credited interest rate set by the insurance company. Unlike whole life insurance, which has fixed premiums and benefits, universal life insurance allows policyholders to adjust their premiums and death benefits within certain limits, offering a high degree of flexibility.

Key Features of Universal Life Insurance

- Flexible Premiums: One of the standout features of universal life insurance is its flexibility in premium payments. Policyholders can adjust the amount and frequency of their premiums within the policy’s guidelines. This flexibility allows you to increase or decrease payments based on your financial situation, making it easier to manage during periods of economic change or personal financial shifts.

- Adjustable Death Benefit: Universal life insurance allows you to modify the death benefit amount. You can increase or decrease the coverage amount depending on your needs. For instance, if you experience a significant life event such as the birth of a child or a change in financial obligations, you can adjust your death benefit to match your new circumstances.

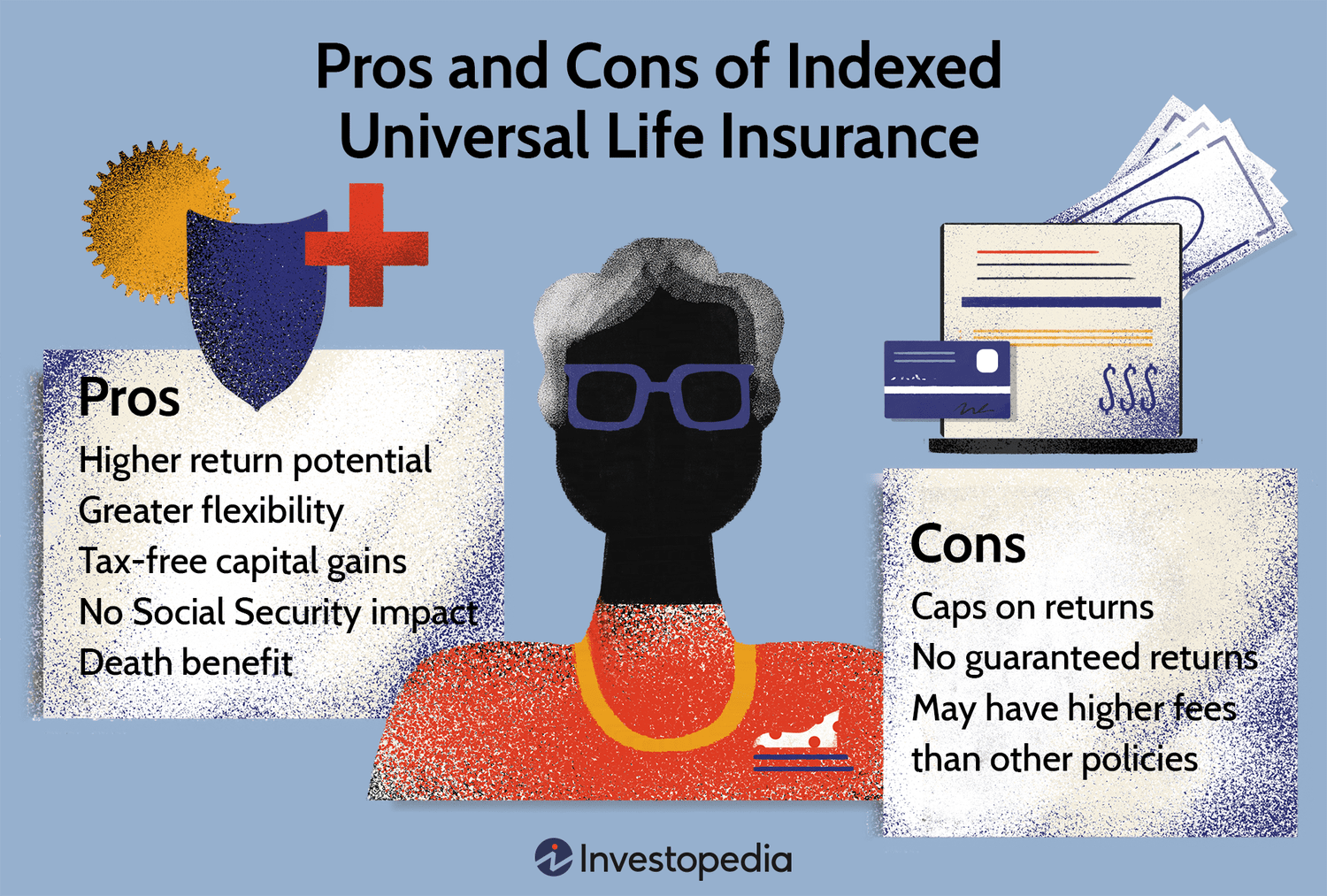

- Cash Value Growth: The cash value component of a universal life insurance policy grows based on a credited interest rate. This rate can vary, but it is typically linked to a benchmark interest rate or index. The cash value can be used to pay premiums, taken as a loan, or withdrawn. This provides a source of funds for emergencies or other financial needs, offering a level of liquidity that many other insurance products do not.

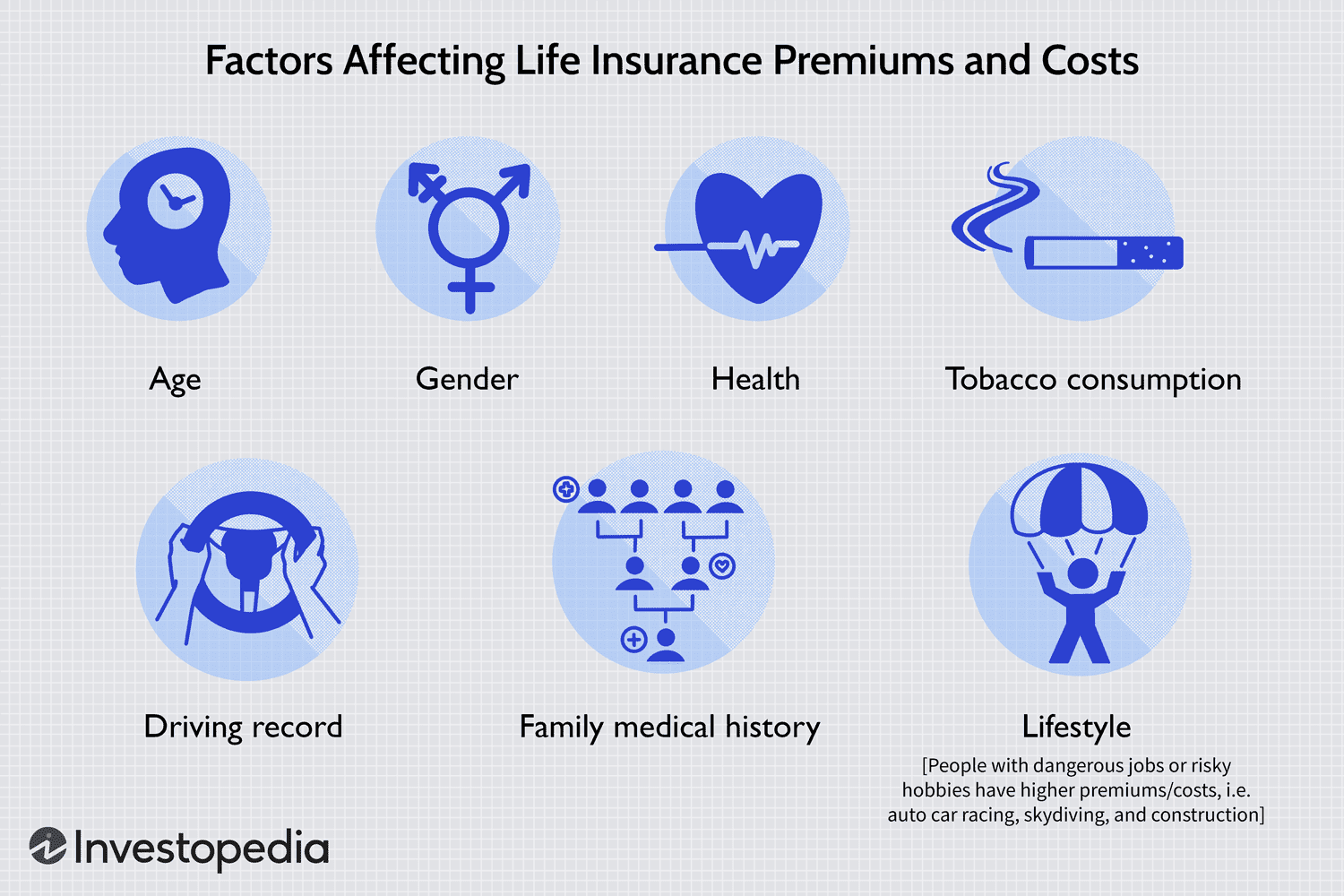

- Cost of Insurance: Universal life insurance policies have a cost of insurance (COI) that is deducted from the cash value. The COI can vary based on factors like age, health, and policy specifics. Understanding how these costs impact your policy is essential for effective financial planning.

Benefits for Financial Planning

- Customized Coverage: The ability to adjust premiums and death benefits makes universal life insurance a highly customizable option. This flexibility allows you to align your insurance coverage with your evolving financial goals and life events. Whether you need to increase coverage as your family grows or reduce it as you approach retirement, universal life insurance can adapt to your needs.

- Tax-Deferred Growth: The cash value of a universal life insurance policy grows on a tax-deferred basis. This means you won’t owe taxes on the growth until you withdraw it. This tax advantage can enhance your long-term savings strategy and help in managing your overall tax liability.

- Supplemental Retirement Income: The cash value accumulated in a universal life insurance policy can be used as a source of supplemental income during retirement. By accessing the cash value through withdrawals or loans, you can provide additional financial support in your later years, supplementing other retirement savings and income sources.

- Estate Planning: Universal life insurance can be an effective tool in estate planning. The death benefit can help cover estate taxes, ensuring that more of your estate is passed on to your heirs. Additionally, the policy’s flexibility allows you to adjust coverage as your estate planning needs change over time.

Considerations and Limitations

While universal life insurance offers significant flexibility, it is important to be aware of its limitations:

- Complexity: Universal life insurance policies can be complex, with various components and options that require careful management. Understanding how changes in premiums, death benefits, and cash value impact your policy is crucial.

- Interest Rates: The credited interest rate on the cash value can fluctuate, impacting the growth of your cash value and potentially affecting your ability to meet policy costs.

- Costs: The cost of insurance and policy fees can affect the cash value and overall performance of your policy. It’s important to review these costs and how they impact your long-term financial planning.

Conclusion

Universal life insurance offers a blend of flexibility and financial planning benefits that can be tailored to meet your changing needs and goals. Its customizable premiums, adjustable death benefits, and cash value growth provide valuable tools for managing your financial future. However, it’s essential to understand the complexities and costs associated with this type of insurance to make informed decisions.

Consulting with a financial advisor or insurance professional can help you navigate the details of universal life insurance and determine if it’s the right fit for your long-term financial strategy. By leveraging its features effectively, you can enhance your financial planning and ensure that your insurance coverage evolves with your life’s journey.