When navigating health insurance plans, understanding deductibles and co-pays is crucial for managing your healthcare costs effectively. These terms play a significant role in determining how much you’ll pay out-of-pocket for medical services and can significantly impact your overall healthcare expenses. Here’s a comprehensive guide to help you understand health insurance deductibles and co-pays and how they affect your financial responsibilities.

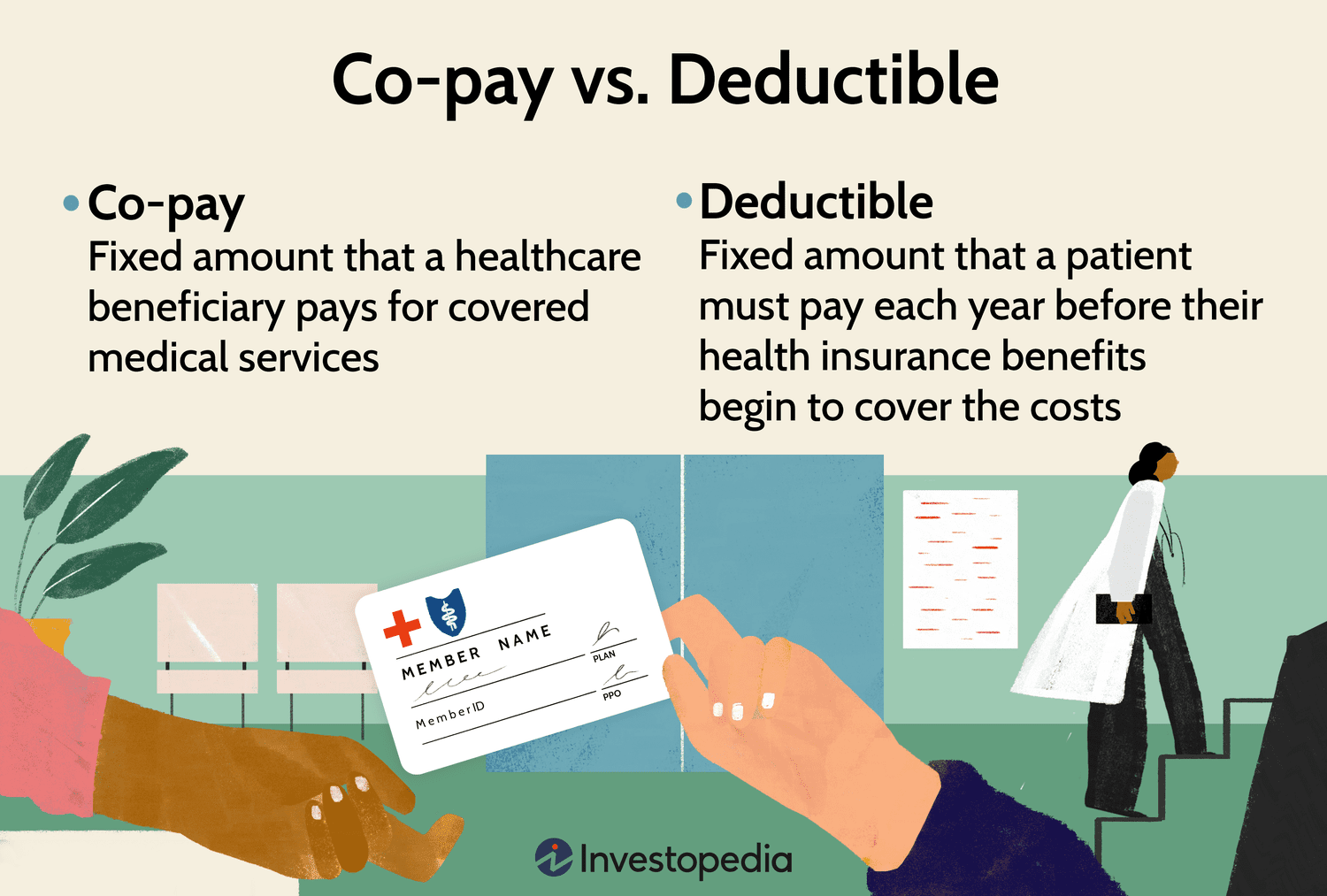

1. What is a Deductible?

A deductible is the amount you must pay out-of-pocket for covered medical expenses before your health insurance begins to contribute. Deductibles are typically expressed as an annual amount, such as $1,000 or $2,500. Here’s how it works:

- Annual Deductible: This is the total amount you need to pay in a calendar year. Once you meet your deductible by paying this amount for covered services, your insurance starts sharing the costs.

- Covered Services: Not all services may count towards your deductible. For instance, preventive care (like vaccinations and screenings) often doesn’t count towards the deductible and may be covered at no additional cost under many plans.

2. Types of Deductibles

There are various types of deductibles to be aware of:

- Individual Deductible: The amount one person must pay before the insurance starts to cover their costs.

- Family Deductible: In a family plan, this is the total amount the family must pay collectively before the insurance covers any expenses. Some plans also have an individual deductible within the family deductible, where each member has a certain amount they must pay before coverage starts for them individually.

3. What is a Co-pay?

A co-pay (or copayment) is a fixed amount you pay for a specific healthcare service or prescription at the time of service. Unlike deductibles, co-pays are due at the time of receiving care rather than annually. Here’s what you need to know:

- Fixed Costs: Co-pays are typically set amounts, such as $20 for a doctor’s visit or $10 for a prescription. These amounts are predefined by your insurance plan and do not change based on the cost of the service.

- Varied by Service: Co-pays can vary depending on the type of service or provider. For example, you might have a different co-pay for a primary care visit compared to a specialist visit.

4. How Deductibles and Co-pays Work Together

Both deductibles and co-pays work together to determine your total out-of-pocket costs. Here’s how they interact:

- Before the Deductible: If you haven’t met your deductible, you’ll pay the full amount of covered services up to your deductible limit. For services covered before meeting the deductible, you might have to pay co-pays or the entire amount until you reach the deductible.

- After the Deductible: Once you meet your deductible, your insurance begins to share the costs. You’ll then pay co-pays for services, or in some plans, you might pay coinsurance, which is a percentage of the cost rather than a fixed amount.

5. Coinsurance vs. Co-pays

Coinsurance is another cost-sharing method that’s often confused with co-pays:

- Coinsurance: This is a percentage of the cost of a service that you pay after meeting your deductible. For example, if you have a 20% coinsurance, you would pay 20% of the cost of the service, while your insurance covers the remaining 80%.

- Co-pays: Unlike coinsurance, co-pays are fixed amounts and do not depend on the total cost of the service.

6. Impact on Healthcare Costs

Understanding your deductible and co-pay requirements is essential for managing your healthcare costs:

- Plan Selection: When choosing a health insurance plan, consider both the deductible and co-pays. A plan with a lower deductible might have higher co-pays, and vice versa. Balance these costs based on your anticipated healthcare needs and budget.

- Budgeting: Be aware of your plan’s deductible and co-pay amounts to budget for your healthcare expenses effectively. Keep track of how much you’ve paid towards your deductible and monitor co-pay expenses throughout the year.

7. Preventive Care and Cost

Many health insurance plans cover preventive services, such as screenings and vaccinations, at no additional cost, meaning these services might not count towards your deductible or require a co-pay. It’s important to understand what preventive care is covered and how it affects your overall cost.

Conclusion

Navigating health insurance deductibles and co-pays is crucial for managing your out-of-pocket expenses and understanding how your insurance plan works. By comprehending the distinctions between deductibles and co-pays, and how they impact your overall costs, you can make more informed decisions about your health insurance plan and better prepare for healthcare expenses. Always review your plan details carefully and consult with your insurance provider if you have any questions about your deductible, co-pays, or other cost-sharing elements.